It can be intimidating to deal with documents you’ve never seen before, such as IRS Form 4549, which is often issued after an audit. This form outlines the IRS’s proposed changes to your taxable income and may result in additional taxes owed, adjustments to tax credits, or other changes to your income tax return.

Understanding this form is key to knowing your rights, options, and next steps, whether you’re dealing with processing audits, responding to an overdue tax return inquiry, or facing corrections to an original return. IRS Form 4549 doesn’t carry the same weight as a court decision, but it can set things in motion, especially if you don’t respond. In some cases, it may even be subject to judicial review if the disagreement escalates.

Let’s break down what this form is all about.

What is Form 4549?

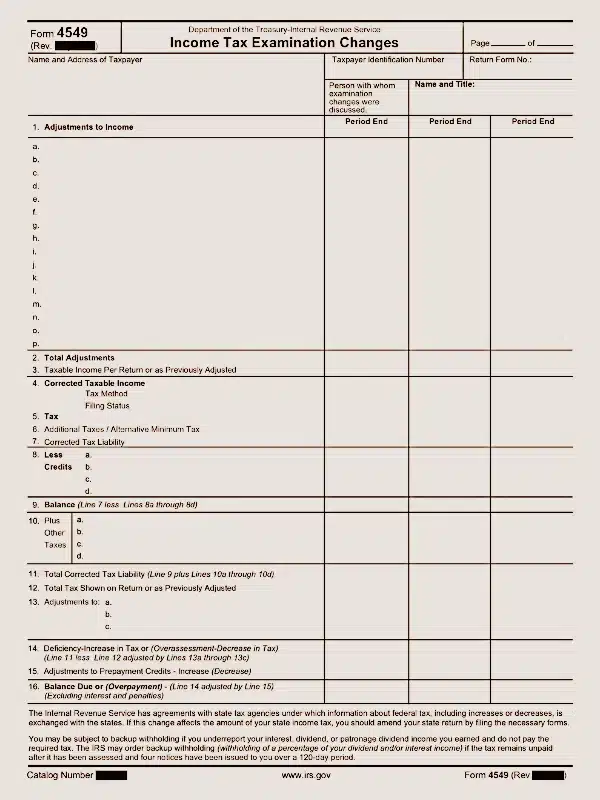

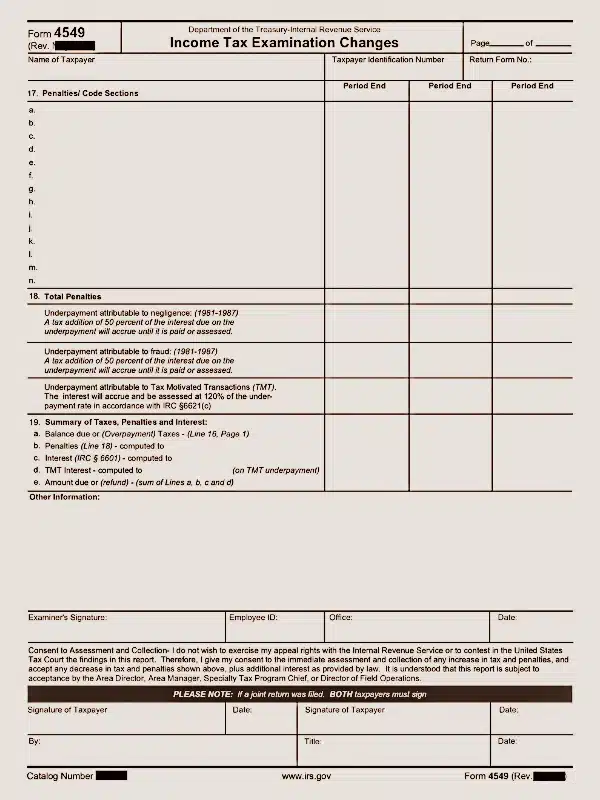

IRS Form 4549, also known as the Income Tax Examination Changes form, is issued to taxpayers when the IRS completes an audit and determines that changes are needed to a previously filed tax return. This document details the audit findings and includes any proposed adjustments to income, deductions, and credits based on the results of the examination.

The form provides a detailed summary of changes, such as corrected taxable income and revised tax calculations, and is the official document by which the IRS communicates its position after reviewing your return. If you receive this form, it indicates that the IRS audit process is complete, and that the agency believes certain corrections should be made.

Receiving Form 4549 does not necessarily mean there are no remaining options. You can review the findings and either accept or dispute the proposed adjustments.

Information Contained in Form 4549

When the IRS completes an audit and issues Form 4549, it outlines the audit adjustments that resulted from its review. This document helps both the IRS and the taxpayer clearly understand the differences between what was originally filed, and what the IRS believes should have been reported. Whether it’s your first audit or a previous audit that led to further review, understanding this form is essential.

Form 4549 typically covers the following information:

- Adjustments to income: Corrections made to the income reported on your original return.

- Total adjustments: A summary of all adjustments made during the audit.

- Taxable income: The corrected amount of taxable income after adjustments.

- Corrected tax liability: The recalculated tax based on the adjusted figures.

- Additional taxes or AMT (Alternative Minimum Tax): Any other taxes owed as a result of the audit.

- Total tax shown on the return vs. corrected tax liability: Helps identify any deficiencies (underpayments) or overpayments.

- Penalties and interest: Charges added due to underreporting, late payment, or errors.

- Balance due: The final amount owed to the IRS after all calculations and adjustments are applied.

Understanding each of these elements can help you decide how to respond to the IRS’s proposed changes.

Reasons for Issuing IRS Form 4549

Receiving IRS Form 4549 usually means that the IRS has completed an initial audit and found discrepancies in your tax return. These discrepancies can be due to different factors, such as unreported income, excessive deductions, or miscalculations, that lead the IRS to believe that your return does not accurately reflect your actual tax liability.

In some cases, audits are triggered by suspicious patterns or red flags, while in others, taxpayers undergo random selection as part of the IRS’s routine compliance efforts. Regardless of how the audit begins, if the IRS determines that changes are necessary after reviewing your records, Form 4549 is issued to formally present those audit findings and proposed changes.

Sometimes the form reflects concerns about potential tax evasion or willful misreporting. But even in more common cases, it simply means that the IRS wants to correct your return to conform to its records and findings.

How to Address Form 4549 of the IRS

When you receive IRS Form 4549, it’s important to take it seriously. This form not only summarizes the proposed changes to your tax return, it also outlines a recalculated tax liability, including any associated penalties and interest, which can significantly affect your overall financial obligations.

After reviewing the form, you have two main options:

- Agree with the changes and sign Form 4549, indicating your acceptance of the IRS’s findings.

- Disagree with the proposed changes and choose not to sign the form, preserving your right to contest the results.

If you disagree with the auditor’s findings, do not sign Form 4549, as doing so will waive your right to pursue audit reconsideration options or further appeal.

How you respond will depend on your particular situation.

If You Agree With Form 4549

If, after reviewing the IRS’s proposed changes, you agree with the findings on Form 4549, the next step is to sign and return the form. This indicates that you accept the adjustments for your tax period, including any revised tax liability and penalties.

In some cases, especially if the proposed changes do not increase your total tax amount, it may not be necessary to sign the form. However, if you do sign, be aware that you are acknowledging your responsibility for any taxes owed, as well as any related penalties and interest.

If you can’t pay the full amount at once, don’t ignore the balance. Instead, contact the IRS to explore tax resolution options to manage your liability without additional stress.

If You Disagree With IRS Form 4549

If you disagree with the findings outlined in IRS Form 4549, you have the right to dispute the IRS’s proposed changes. This is an important opportunity to challenge audit results you believe are incorrect or incomplete.

To start the process, you must file an appeal by submitting Form 12661: Disagreement with Proposed Adjustment along with a written statement explaining the reason for your disagreement and any additional documentation that supports your case. This audit reconsideration form must be submitted within 30 days of the date on Form 4549 to initiate a valid request for appeals review.

Do not sign Form 4549 if you disagree with it—doing so waives your right to challenge the IRS’s proposed changes. Instead, if no agreement is reached, the IRS will issue a Notice of Deficiency, giving you a 90-day period (or 150 days if you’re outside the U.S.) to file a petition with the U.S. Tax Court. For detailed instructions on how to begin the reconsideration process, refer to Community Tax’s guide to IRS Audit Reconsideration.

Given the stakes and complexity of the audit process, it’s often best to seek the help of a qualified tax professional who can guide you through the appeal and represent your best interests.

IRS Form 4549: Are There Any Other Versions?

The IRS may use variations of IRS Form 4549 to report audit findings and proposed tax return adjustments. One such variation is Form 4549-E, Income Tax Discrepancy Adjustment, which may be used in certain audit scenarios to summarize findings and proposed changes.

Understanding the differences between IRS Form 4549 and its related versions is important for taxpayers, as each may have unique implications regarding tax liability and compliance. While the structure and naming of these forms may vary, they all serve to inform the taxpayer of proposed changes following an audit and outline the next steps.

In any post-audit interaction with the IRS, consulting with a tax professional can make all the difference in determining how to proceed. These professionals can help you interpret which version of the form you’ve received and what actions are appropriate.

When reviewing each form, note these differences:

- Form 4549 (Income Tax Examination Changes): The most commonly used version. Summarizes adjustments to income, deductions, and credits after a standard audit. Used for both individuals and businesses, depending on the context.

- Form 4549-E (Income Tax Discrepancy Adjustment): Typically shorter, used when the IRS identifies a discrepancy between reported income and third-party information (such as W-2s or 1099s). It’s focused on a single issue or set of transactions rather than a full examination.

- Form 4549-A: Often used for detailed calculations and adjustments. This version may be attached to Form 4549 or used when the case requires extended calculations over multiple tax years.

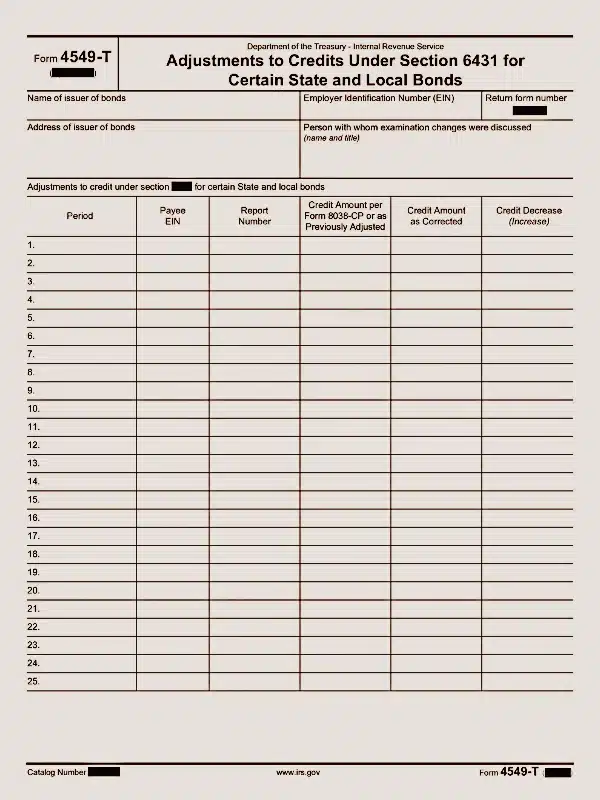

- Form 4549-T: Used specifically in Tax Court cases or when the IRS is working with disputed issues already under judicial review. This version may contain sections relevant to litigation or court stipulations.

While the layouts and labels vary, all forms require careful review. Each version is a formal document that reflects the IRS’s proposed view of your taxable income, tax liability, and potential additional taxes.

Form 4549-E (Income Tax Discrepancy Adjustment)

Form 4549-E is used by the IRS specifically for tax discrepancy adjustments when there are proposed changes to a return that appear inconsistent with the information reviewed during the examination. This form is more targeted than the standard IRS Form 4549 and is often used when the IRS identifies specific issues that need correction, rather than conducting a full audit.

The form highlights a discrepancy between the taxpayer’s original filing and data the IRS has obtained, typically from third-party sources such as employers, banks, or financial institutions. For example, a taxpayer may receive Form 4549-E when the IRS finds unreported income or errors, such as misreported distributions from deferred compensation plans.

Form 4549-E is often accompanied by Letter 3605-A, which provides additional explanation and context regarding the proposed changes and outlines the steps the taxpayer can take in response.

Receiving Form 4549-E means the IRS does not believe the taxpayer has filed an accurate return and is formally proposing changes to correct the record.

For IRS Form 4549 Tax Help, Get in Touch With Community Tax

IRS Form 4549 can appear intimidating, as the proposed changes may affect your financial situation or trigger a deeper review. Therefore, it’s advisable to seek professional advice from a trusted source. Consulting with a tax professional, such as a CPA, will ensure that your return is accurate, your supporting documentation is well-organized, and your rights are protected throughout the audit reconsideration process.

Community Tax offers professional tax planning and tax assistance for individuals and businesses facing IRS audits and related issues. With more than a decade of experience and thousands of positive reviews, Community Tax has built a reputation for providing practical, personalized tax advice to clients nationwide. Whether you need to file a Request for Appeals Review or respond to a potential Tax Court situation, our team can help you find a viable solution based on your specific case.

In many cases, Community Tax has assisted with IRS adjustments by assembling the necessary relevant documentation and successfully arguing our clients’ position through the audit review process, ultimately reducing the amount owed and avoiding court escalation.

If you receive Form 4549, don’t wait. The sooner you act, the better your chances of a favorable resolution. Contact Community Tax today for reliable, trusted tax help.

IRS Form 4549 FAQs

It can be intimidating to deal with documents you’ve never seen before, such as IRS Form 4549, which is often issued after an audit. This form outlines the IRS’s proposed changes to your taxable income and may result in additional taxes owed, adjustments to tax credits, or other changes to your income tax return.

Understanding this form is key to knowing your rights, options, and next steps, whether you’re dealing with processing audits, responding to an overdue tax return inquiry, or facing corrections to an original return. IRS Form 4549 doesn’t carry the same weight as a court decision, but it can set things in motion, especially if you don’t respond. In some cases, it may even be subject to judicial review if the disagreement escalates.

Let’s break down what this form is all about.

What is Form 4549?

IRS Form 4549, also known as the Income Tax Examination Changes form, is issued to taxpayers when the IRS completes an audit and determines that changes are needed to a previously filed tax return. This document details the audit findings and includes any proposed adjustments to income, deductions, and credits based on the results of the examination.

The form provides a detailed summary of changes, such as corrected taxable income and revised tax calculations, and is the official document by which the IRS communicates its position after reviewing your return. If you receive this form, it indicates that the IRS audit process is complete, and that the agency believes certain corrections should be made.

Receiving Form 4549 does not necessarily mean there are no remaining options. You can review the findings and either accept or dispute the proposed adjustments.

Information Contained in Form 4549

When the IRS completes an audit and issues Form 4549, it outlines the audit adjustments that resulted from its review. This document helps both the IRS and the taxpayer clearly understand the differences between what was originally filed, and what the IRS believes should have been reported. Whether it’s your first audit or a previous audit that led to further review, understanding this form is essential.

Form 4549 typically covers the following information:

- Adjustments to income: Corrections made to the income reported on your original return.

- Total adjustments: A summary of all adjustments made during the audit.

- Taxable income: The corrected amount of taxable income after adjustments.

- Corrected tax liability: The recalculated tax based on the adjusted figures.

- Additional taxes or AMT (Alternative Minimum Tax): Any other taxes owed as a result of the audit.

- Total tax shown on the return vs. corrected tax liability: Helps identify any deficiencies (underpayments) or overpayments.

- Penalties and interest: Charges added due to underreporting, late payment, or errors.

- Balance due: The final amount owed to the IRS after all calculations and adjustments are applied.

Understanding each of these elements can help you decide how to respond to the IRS’s proposed changes.

Reasons for Issuing IRS Form 4549

Receiving IRS Form 4549 usually means that the IRS has completed an initial audit and found discrepancies in your tax return. These discrepancies can be due to different factors, such as unreported income, excessive deductions, or miscalculations, that lead the IRS to believe that your return does not accurately reflect your actual tax liability.

In some cases, audits are triggered by suspicious patterns or red flags, while in others, taxpayers undergo random selection as part of the IRS’s routine compliance efforts. Regardless of how the audit begins, if the IRS determines that changes are necessary after reviewing your records, Form 4549 is issued to formally present those audit findings and proposed changes.

Sometimes the form reflects concerns about potential tax evasion or willful misreporting. But even in more common cases, it simply means that the IRS wants to correct your return to conform to its records and findings.

How to Address Form 4549 of the IRS

When you receive IRS Form 4549, it’s important to take it seriously. This form not only summarizes the proposed changes to your tax return, it also outlines a recalculated tax liability, including any associated penalties and interest, which can significantly affect your overall financial obligations.

After reviewing the form, you have two main options:

- Agree with the changes and sign Form 4549, indicating your acceptance of the IRS’s findings.

- Disagree with the proposed changes and choose not to sign the form, preserving your right to contest the results.

If you disagree with the auditor’s findings, do not sign Form 4549, as doing so will waive your right to pursue audit reconsideration options or further appeal.

How you respond will depend on your particular situation.

If You Agree With Form 4549

If, after reviewing the IRS’s proposed changes, you agree with the findings on Form 4549, the next step is to sign and return the form. This indicates that you accept the adjustments for your tax period, including any revised tax liability and penalties.

In some cases, especially if the proposed changes do not increase your total tax amount, it may not be necessary to sign the form. However, if you do sign, be aware that you are acknowledging your responsibility for any taxes owed, as well as any related penalties and interest.

If you can’t pay the full amount at once, don’t ignore the balance. Instead, contact the IRS to explore tax resolution options to manage your liability without additional stress.

If You Disagree With IRS Form 4549

If you disagree with the findings outlined in IRS Form 4549, you have the right to dispute the IRS’s proposed changes. This is an important opportunity to challenge audit results you believe are incorrect or incomplete.

To start the process, you must file an appeal by submitting Form 12661: Disagreement with Proposed Adjustment along with a written statement explaining the reason for your disagreement and any additional documentation that supports your case. This audit reconsideration form must be submitted within 30 days of the date on Form 4549 to initiate a valid request for appeals review.

Do not sign Form 4549 if you disagree with it—doing so waives your right to challenge the IRS’s proposed changes. Instead, if no agreement is reached, the IRS will issue a Notice of Deficiency, giving you a 90-day period (or 150 days if you’re outside the U.S.) to file a petition with the U.S. Tax Court. For detailed instructions on how to begin the reconsideration process, refer to Community Tax’s guide to IRS Audit Reconsideration.

Given the stakes and complexity of the audit process, it’s often best to seek the help of a qualified tax professional who can guide you through the appeal and represent your best interests.

IRS Form 4549: Are There Any Other Versions?

The IRS may use variations of IRS Form 4549 to report audit findings and proposed tax return adjustments. One such variation is Form 4549-E, Income Tax Discrepancy Adjustment, which may be used in certain audit scenarios to summarize findings and proposed changes.

Understanding the differences between IRS Form 4549 and its related versions is important for taxpayers, as each may have unique implications regarding tax liability and compliance. While the structure and naming of these forms may vary, they all serve to inform the taxpayer of proposed changes following an audit and outline the next steps.

In any post-audit interaction with the IRS, consulting with a tax professional can make all the difference in determining how to proceed. These professionals can help you interpret which version of the form you’ve received and what actions are appropriate.

When reviewing each form, note these differences:

- Form 4549 (Income Tax Examination Changes): The most commonly used version. Summarizes adjustments to income, deductions, and credits after a standard audit. Used for both individuals and businesses, depending on the context.

- Form 4549-E (Income Tax Discrepancy Adjustment): Typically shorter, used when the IRS identifies a discrepancy between reported income and third-party information (such as W-2s or 1099s). It’s focused on a single issue or set of transactions rather than a full examination.

- Form 4549-A: Often used for detailed calculations and adjustments. This version may be attached to Form 4549 or used when the case requires extended calculations over multiple tax years.

- Form 4549-T: Used specifically in Tax Court cases or when the IRS is working with disputed issues already under judicial review. This version may contain sections relevant to litigation or court stipulations.

While the layouts and labels vary, all forms require careful review. Each version is a formal document that reflects the IRS’s proposed view of your taxable income, tax liability, and potential additional taxes.

Form 4549-E (Income Tax Discrepancy Adjustment)

Form 4549-E is used by the IRS specifically for tax discrepancy adjustments when there are proposed changes to a return that appear inconsistent with the information reviewed during the examination. This form is more targeted than the standard IRS Form 4549 and is often used when the IRS identifies specific issues that need correction, rather than conducting a full audit.

The form highlights a discrepancy between the taxpayer’s original filing and data the IRS has obtained, typically from third-party sources such as employers, banks, or financial institutions. For example, a taxpayer may receive Form 4549-E when the IRS finds unreported income or errors, such as misreported distributions from deferred compensation plans.

Form 4549-E is often accompanied by Letter 3605-A, which provides additional explanation and context regarding the proposed changes and outlines the steps the taxpayer can take in response.

Receiving Form 4549-E means the IRS does not believe the taxpayer has filed an accurate return and is formally proposing changes to correct the record.

For IRS Form 4549 Tax Help, Get in Touch With Community Tax

IRS Form 4549 can appear intimidating, as the proposed changes may affect your financial situation or trigger a deeper review. Therefore, it’s advisable to seek professional advice from a trusted source. Consulting with a tax professional, such as a CPA, will ensure that your return is accurate, your supporting documentation is well-organized, and your rights are protected throughout the audit reconsideration process.

Community Tax offers professional tax planning and tax assistance for individuals and businesses facing IRS audits and related issues. With more than a decade of experience and thousands of positive reviews, Community Tax has built a reputation for providing practical, personalized tax advice to clients nationwide. Whether you need to file a Request for Appeals Review or respond to a potential Tax Court situation, our team can help you find a viable solution based on your specific case.

In many cases, Community Tax has assisted with IRS adjustments by assembling the necessary relevant documentation and successfully arguing our clients’ position through the audit review process, ultimately reducing the amount owed and avoiding court escalation.

If you receive Form 4549, don’t wait. The sooner you act, the better your chances of a favorable resolution. Contact Community Tax today for reliable, trusted tax help.