Navigating the labyrinth of tax obligations can be daunting, and sometimes missteps occur, leading to penalties from the Internal Revenue Service (IRS). However, taxpayers have a potential ally in their corner: the IRS Penalty Abatement. This provision can offer significant relief by reducing or even eliminating certain penalties. In this article, we’ll delve into the benefits of the IRS Penalty Abatement, offering a comprehensive guide on its advantages and a step-by-step approach on how to apply for it. Whether you’re a seasoned taxpayer or just starting on your fiscal journey, understanding this tool can be pivotal in managing and minimizing tax-related penalties.

Siéntase libre de utilizar nuestro índice a continuación para navegar fácilmente a través de nuestro artículo.

¿Qué significa la reducción de penalizaciones del IRS por primera vez?

The term “penalty” can indeed be daunting. It often implies an added financial burden due to an oversight or misunderstanding in one’s tax obligations. Recognizing that everyone can make mistakes, the IRS introduced the First-Time Penalty Abatement; a measure that offers a semblance of relief to taxpayers who’ve had a minor slip for the first time. This one-time waiver serves as a buffer against certain penalties, ensuring that individuals are not excessively punished for a singular oversight. While it’s not a carte blanche, it does provide a reprieve, especially from penalties such as the late filing penalty. The abatement underscores the importance of staying informed and proactive in tax matters, especially if you’ve missed a deadline or underpaid in the past.

¿Qué penalizaciones están cubiertas por la reducción de penalizaciones por primera vez?

Las penalizaciones impuestas por el IRS a veces pueden ser agobiantes, y es vital entender cuáles pueden ser objeto de la reducción de penalizaciones del IRS por primera vez. Las principales penalizaciones que pueden abordarse bajo esta disposición incluyen:

- Impuestos sobre la nómina e impuestos sobre el empleo: These relate to the withholding taxes that employers deduct from their employees’ salaries. Any discrepancy or failure in depositing these taxes can lead to substantial penalties.

- Penalización por no presentar la declaración: This penalty is imposed when a taxpayer does not file by the tax-filing deadline. It’s calculated based on the time from the deadline to the date the return is filed.

- Penalización por falta de pago: Se impone cuando los contribuyentes no pagan la totalidad de los impuestos declarados en su declaración antes de la fecha de vencimiento. Esta multa suele ser del 0.5% del impuesto debido por cada mes, o parte de un mes, que el impuesto permanece sin pagar después de la fecha de vencimiento, hasta el 25%.

- Penalización por falta de depósito: Applicable to businesses that don’t deposit employment taxes (like Social Security or withheld income taxes) in a timely fashion.

- Penalizaciones relacionadas con la precisión: Estas pueden imponerse si existe una falta de pago significativa relacionada con negligencia, una infravaloración sustancial del impuesto sobre los ingresos o cualquier tergiversación de los hechos.

Aunque la reducción de penalizaciones del IRS por primera vez ofrece un respiro de estas y otras penalizaciones, como las emitidas bajo el Aviso CP215, es vital recordar que no todas las penalizaciones del IRS cumplen los requisitos. Siempre consulte las pautas oficiales del IRS o busque el asesoramiento de un profesional de impuestos para determinar los detalles de la elegibilidad para la reducción de penalizaciones.

Criterios de elegibilidad para la reducción de penalizaciones del IRS por primera vez

The IRS doesn’t hand out penalty abatements indiscriminately. There are stringent criteria in place to ensure that only deserving taxpayers benefit from this provision. A crucial factor is the taxpayer’s prior history with the IRS. If you’ve been diligent, without any significant penalties or issues in the recent past, you stand a better chance of qualifying for the abatement. But it’s not just about past behavior. Other factors, including your filing status and which tax brackets you fall into, can influence your eligibility. These elements can determine both the kind and the quantum of relief available under the abatement.

Escribiendo una carta de solicitud de reducción de penalizaciones del IRS

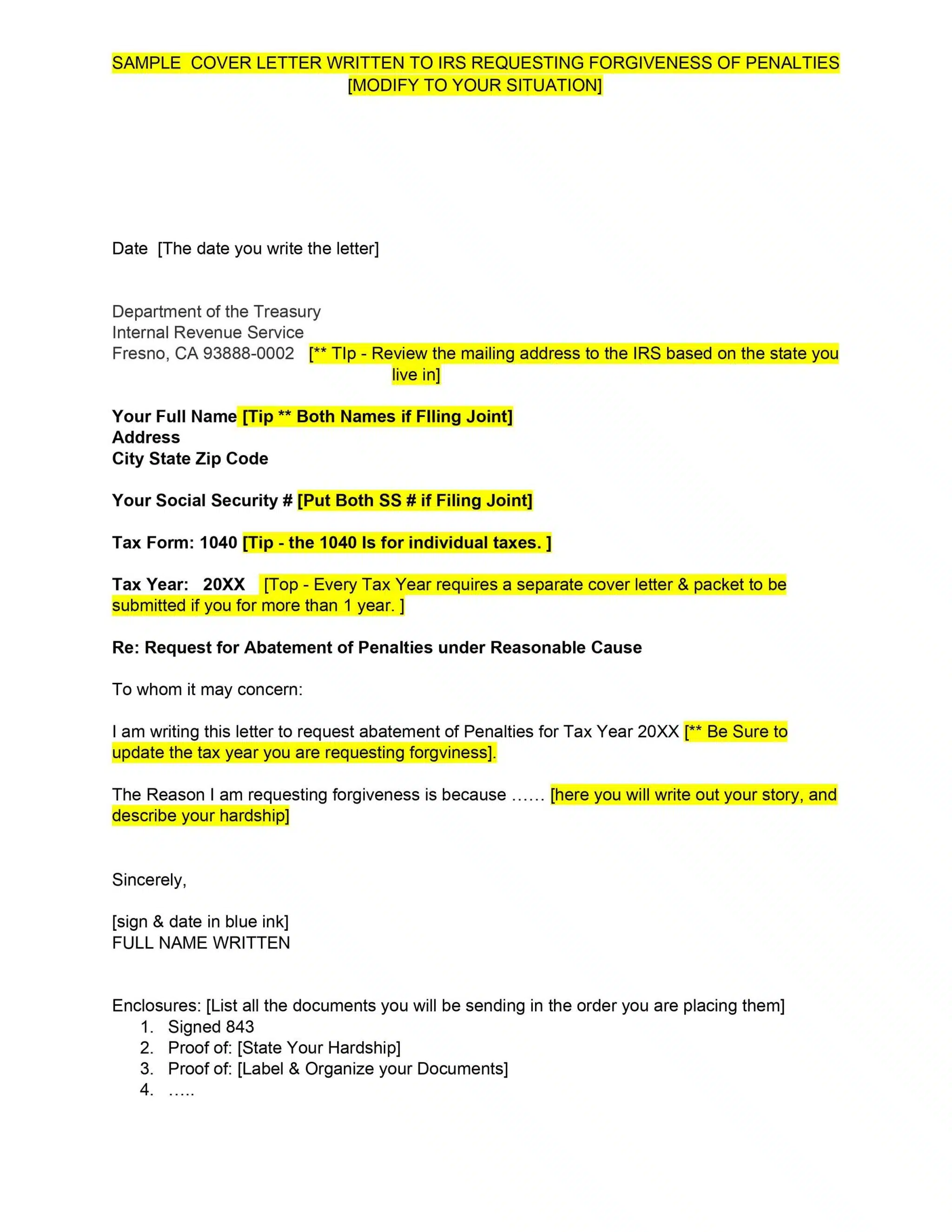

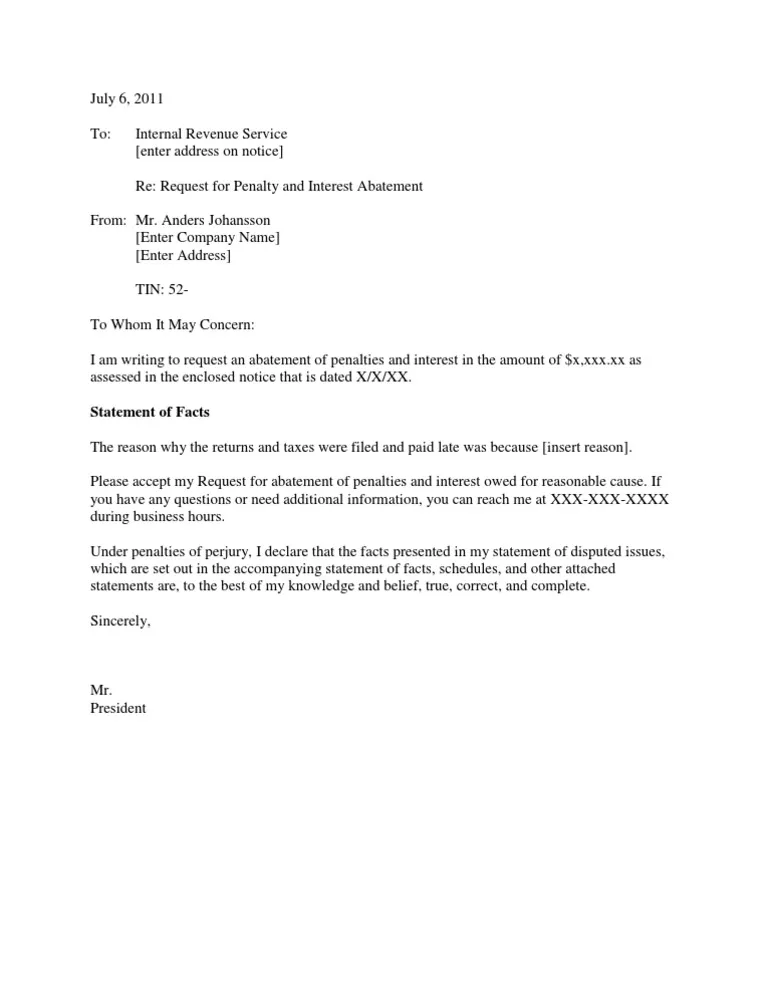

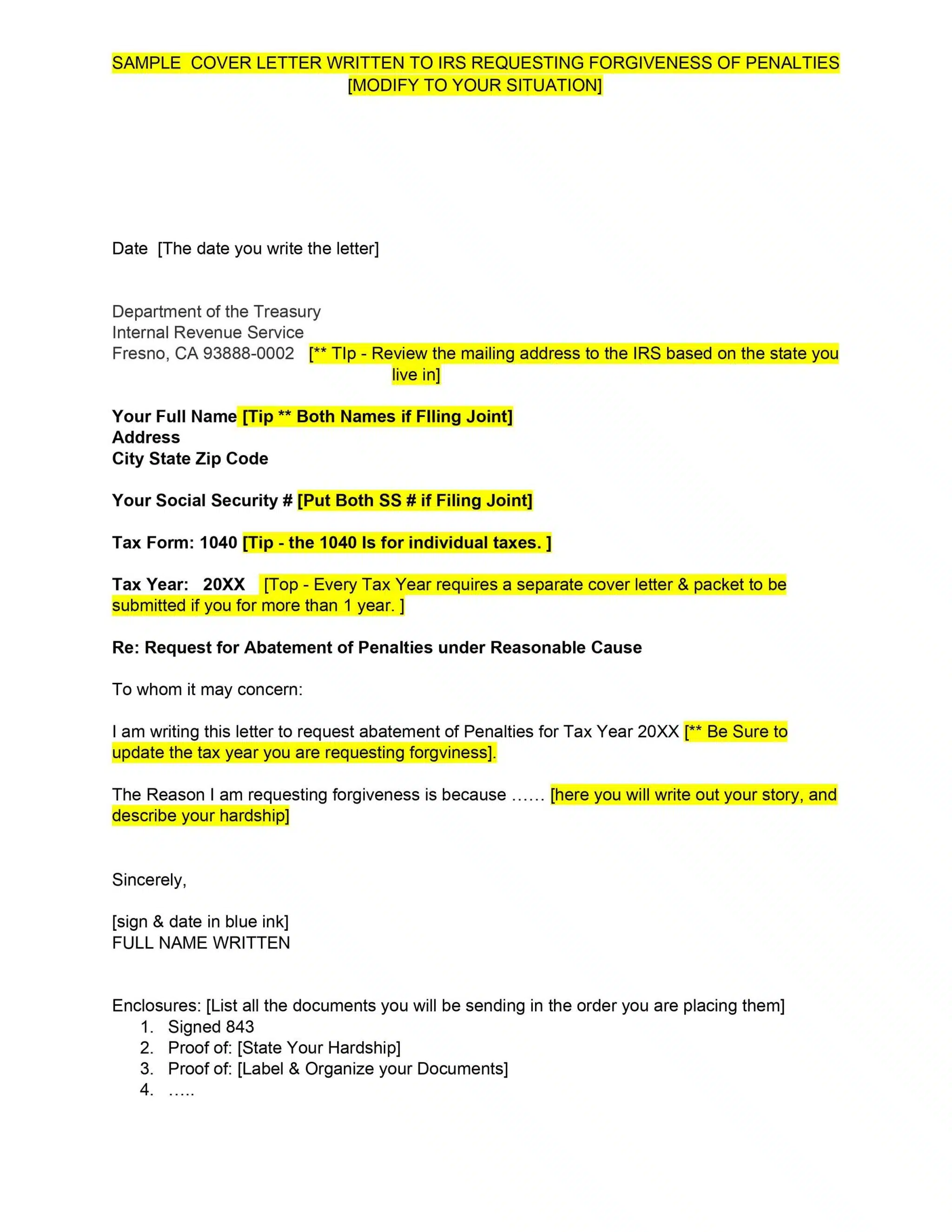

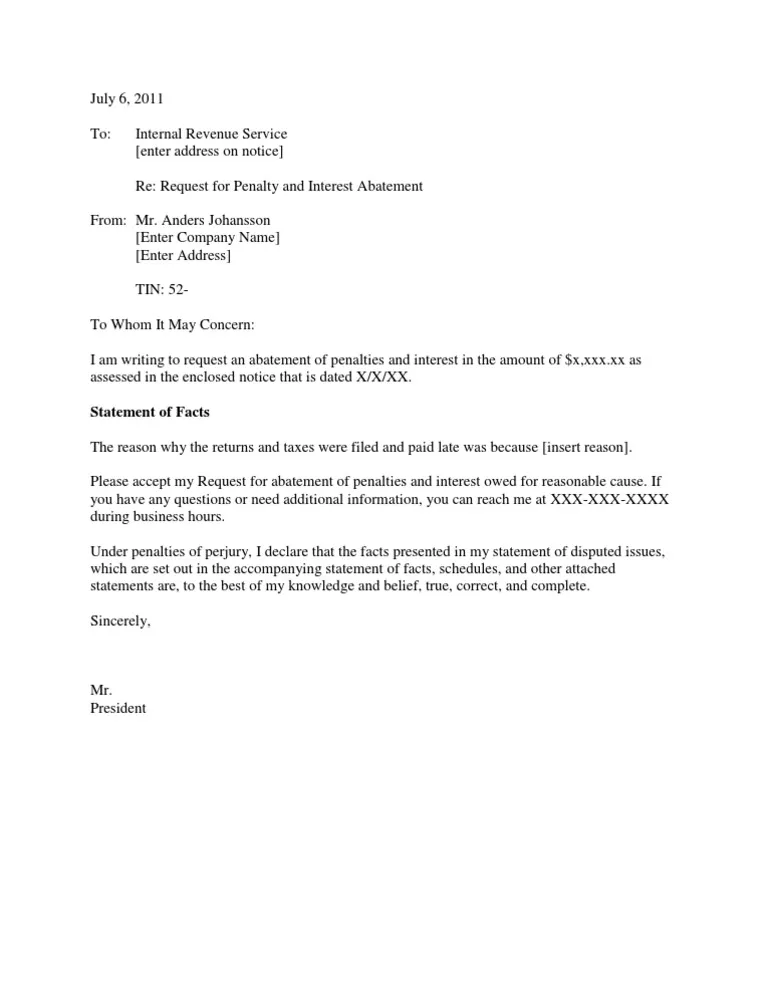

Este documento es su oportunidad de presentar su caso al IRS, explicando las razones detrás de cualquier descuido y haciendo una solicitud formal para el alivio de la penalización. Estos son los pasos y consideraciones clave a la hora de redactar la carta:

- Comience con la información básica: Comience su carta con detalles esenciales. Esto incluye su nombre, dirección, número de Seguro Social o número de identificación del empleador, y el año fiscal en cuestión.

- Proporcione un asunto claro: Something like “Request for Penalty Abatement under First-Time Abate” can quickly inform the reader about the purpose of the letter.

- Explique su situación: Clearly and concisely detail why you believe you’re entitled to the penalty abatement. Were there circumstances beyond your control that caused the delay or oversight?

- Haga referencia a su cumplimiento en el pasado: Si se trata de su primera falta o si tiene un historial de pago puntual de impuestos, menciónelo. El IRS favorece a los contribuyentes que generalmente cumplen con las normas y reglamentos fiscales.

- Adjunte documentos de respaldo: Las pruebas son fundamentales. Adjunte todos los documentos que puedan respaldar su solicitud, como historiales médicos, expedientes laborales o pruebas de problemas económicos imprevistos.

- Busque orientación: Before finalizing and sending off your letter, it might be beneficial to reference a sample IRS penalty abatement request letter or consult a tax professional. They can offer guidance on your draft and ensure you haven’t omitted any crucial information.

- Sea respetuoso y honesto: Mantenga siempre un tono respetuoso en su carta y asegúrese de que todas las declaraciones que haga sean veraces y precisas.

- Concluya con una llamada a la acción: Finish your letter with a clear request for the abatement of the specific penalties you’ve mentioned and express hope for a favorable resolution.

- Incluya datos de contacto: Asegúrese de proporcionar un número de teléfono o una dirección de correo electrónico donde se le pueda localizar en caso de que el IRS tenga más preguntas.

- Envíe por correo certificado: Esto asegura que tenga un registro de la fecha de envío y recepción por parte del IRS.

Remember, while a well-crafted letter can increase your chances of penalty abatement, there’s no guarantee of success. It’s the combination of a strong argument, clear evidence, and consistent past compliance that often sways the decision in the taxpayer’s favor.

Vea ejemplos de cartas a continuación:

¿Qué es un ejemplo de causa razonable?

‘Reasonable cause’ is a term often used in penalty abatement scenarios, referring to valid reasons that might have led a taxpayer to miss a deadline or make an error in their tax filings. Examples of reasonable cause can vary widely but understanding a few can help shape your abatement request. Financial hardship is one of the most commonly cited reasons. This could encompass situations where a sudden and unexpected financial burden—like a medical emergency or sudden job loss—affected a taxpayer’s ability to pay on time.

Similarly, a significant negative hit to one’s credit score due to unforeseen circumstances can also be considered a reasonable cause, as it can limit one’s access to credit or loans needed to settle tax balances. When invoking a reasonable cause in your letter, it’s essential to provide evidence supporting your claim and be prepared to discuss it further if the IRS requires additional clarification.

Ayuda para la reducción de penalizaciones del IRS a través de Community Tax

Navigating the complexities of IRS Penalty Abatement can be daunting, especially when dealing with the intricacies of the tax code and the Internal Revenue Service’s procedures. Community Tax is here to assist. With a team of experienced tax professionals, we’ve aided numerous taxpayers in understanding their rights and options while guiding them through the abatement process. Our expertise in the field ensures that your case is handled efficiently, and we’re equipped to provide clarity on each step, ensuring you’re well-informed throughout.

If you need assistance in presenting your case to the IRS, Community Tax stands as a reliable ally. Leveraging years of experience and understanding the nuances of tax regulations, our team ensures that you’re well-prepared and well-represented in your quest for penalty relief.

The realm of IRS Penalty Abatement may seem overwhelming, but understanding its nuances and having the right guidance can make a world of difference. It’s essential to recognize the value of early action, accurate documentation, and strategic decision-making when approaching abatement scenarios. Community Tax offers that guiding hand, ensuring taxpayers can navigate these challenges with confidence. Remember, while penalties may be daunting, solutions are always within reach, especially with the right expertise and support by your side.

¿Aún tiene preguntas? Consulte nuestra sección de preguntas frecuentes.

FAQs

Navigating the labyrinth of tax obligations can be daunting, and sometimes missteps occur, leading to penalties from the Internal Revenue Service (IRS). However, taxpayers have a potential ally in their corner: the IRS Penalty Abatement. This provision can offer significant relief by reducing or even eliminating certain penalties. In this article, we’ll delve into the benefits of the IRS Penalty Abatement, offering a comprehensive guide on its advantages and a step-by-step approach on how to apply for it. Whether you’re a seasoned taxpayer or just starting on your fiscal journey, understanding this tool can be pivotal in managing and minimizing tax-related penalties.

Siéntase libre de utilizar nuestro índice a continuación para navegar fácilmente a través de nuestro artículo.

¿Qué significa la reducción de penalizaciones del IRS por primera vez?

The term “penalty” can indeed be daunting. It often implies an added financial burden due to an oversight or misunderstanding in one’s tax obligations. Recognizing that everyone can make mistakes, the IRS introduced the First-Time Penalty Abatement; a measure that offers a semblance of relief to taxpayers who’ve had a minor slip for the first time. This one-time waiver serves as a buffer against certain penalties, ensuring that individuals are not excessively punished for a singular oversight. While it’s not a carte blanche, it does provide a reprieve, especially from penalties such as the late filing penalty. The abatement underscores the importance of staying informed and proactive in tax matters, especially if you’ve missed a deadline or underpaid in the past.

¿Qué penalizaciones están cubiertas por la reducción de penalizaciones por primera vez?

Las penalizaciones impuestas por el IRS a veces pueden ser agobiantes, y es vital entender cuáles pueden ser objeto de la reducción de penalizaciones del IRS por primera vez. Las principales penalizaciones que pueden abordarse bajo esta disposición incluyen:

- Impuestos sobre la nómina e impuestos sobre el empleo: These relate to the withholding taxes that employers deduct from their employees’ salaries. Any discrepancy or failure in depositing these taxes can lead to substantial penalties.

- Penalización por no presentar la declaración: This penalty is imposed when a taxpayer does not file by the tax-filing deadline. It’s calculated based on the time from the deadline to the date the return is filed.

- Penalización por falta de pago: Se impone cuando los contribuyentes no pagan la totalidad de los impuestos declarados en su declaración antes de la fecha de vencimiento. Esta multa suele ser del 0.5% del impuesto debido por cada mes, o parte de un mes, que el impuesto permanece sin pagar después de la fecha de vencimiento, hasta el 25%.

- Penalización por falta de depósito: Applicable to businesses that don’t deposit employment taxes (like Social Security or withheld income taxes) in a timely fashion.

- Penalizaciones relacionadas con la precisión: Estas pueden imponerse si existe una falta de pago significativa relacionada con negligencia, una infravaloración sustancial del impuesto sobre los ingresos o cualquier tergiversación de los hechos.

Aunque la reducción de penalizaciones del IRS por primera vez ofrece un respiro de estas y otras penalizaciones, como las emitidas bajo el Aviso CP215, es vital recordar que no todas las penalizaciones del IRS cumplen los requisitos. Siempre consulte las pautas oficiales del IRS o busque el asesoramiento de un profesional de impuestos para determinar los detalles de la elegibilidad para la reducción de penalizaciones.

Criterios de elegibilidad para la reducción de penalizaciones del IRS por primera vez

The IRS doesn’t hand out penalty abatements indiscriminately. There are stringent criteria in place to ensure that only deserving taxpayers benefit from this provision. A crucial factor is the taxpayer’s prior history with the IRS. If you’ve been diligent, without any significant penalties or issues in the recent past, you stand a better chance of qualifying for the abatement. But it’s not just about past behavior. Other factors, including your filing status and which tax brackets you fall into, can influence your eligibility. These elements can determine both the kind and the quantum of relief available under the abatement.

Escribiendo una carta de solicitud de reducción de penalizaciones del IRS

Este documento es su oportunidad de presentar su caso al IRS, explicando las razones detrás de cualquier descuido y haciendo una solicitud formal para el alivio de la penalización. Estos son los pasos y consideraciones clave a la hora de redactar la carta:

- Comience con la información básica: Comience su carta con detalles esenciales. Esto incluye su nombre, dirección, número de Seguro Social o número de identificación del empleador, y el año fiscal en cuestión.

- Proporcione un asunto claro: Something like “Request for Penalty Abatement under First-Time Abate” can quickly inform the reader about the purpose of the letter.

- Explique su situación: Clearly and concisely detail why you believe you’re entitled to the penalty abatement. Were there circumstances beyond your control that caused the delay or oversight?

- Haga referencia a su cumplimiento en el pasado: Si se trata de su primera falta o si tiene un historial de pago puntual de impuestos, menciónelo. El IRS favorece a los contribuyentes que generalmente cumplen con las normas y reglamentos fiscales.

- Adjunte documentos de respaldo: Las pruebas son fundamentales. Adjunte todos los documentos que puedan respaldar su solicitud, como historiales médicos, expedientes laborales o pruebas de problemas económicos imprevistos.

- Busque orientación: Before finalizing and sending off your letter, it might be beneficial to reference a sample IRS penalty abatement request letter or consult a tax professional. They can offer guidance on your draft and ensure you haven’t omitted any crucial information.

- Sea respetuoso y honesto: Mantenga siempre un tono respetuoso en su carta y asegúrese de que todas las declaraciones que haga sean veraces y precisas.

- Concluya con una llamada a la acción: Finish your letter with a clear request for the abatement of the specific penalties you’ve mentioned and express hope for a favorable resolution.

- Incluya datos de contacto: Asegúrese de proporcionar un número de teléfono o una dirección de correo electrónico donde se le pueda localizar en caso de que el IRS tenga más preguntas.

- Envíe por correo certificado: Esto asegura que tenga un registro de la fecha de envío y recepción por parte del IRS.

Remember, while a well-crafted letter can increase your chances of penalty abatement, there’s no guarantee of success. It’s the combination of a strong argument, clear evidence, and consistent past compliance that often sways the decision in the taxpayer’s favor.

Vea ejemplos de cartas a continuación:

¿Qué es un ejemplo de causa razonable?

‘Reasonable cause’ is a term often used in penalty abatement scenarios, referring to valid reasons that might have led a taxpayer to miss a deadline or make an error in their tax filings. Examples of reasonable cause can vary widely but understanding a few can help shape your abatement request. Financial hardship is one of the most commonly cited reasons. This could encompass situations where a sudden and unexpected financial burden—like a medical emergency or sudden job loss—affected a taxpayer’s ability to pay on time.

Similarly, a significant negative hit to one’s credit score due to unforeseen circumstances can also be considered a reasonable cause, as it can limit one’s access to credit or loans needed to settle tax balances. When invoking a reasonable cause in your letter, it’s essential to provide evidence supporting your claim and be prepared to discuss it further if the IRS requires additional clarification.

Ayuda para la reducción de penalizaciones del IRS a través de Community Tax

Navigating the complexities of IRS Penalty Abatement can be daunting, especially when dealing with the intricacies of the tax code and the Internal Revenue Service’s procedures. Community Tax is here to assist. With a team of experienced tax professionals, we’ve aided numerous taxpayers in understanding their rights and options while guiding them through the abatement process. Our expertise in the field ensures that your case is handled efficiently, and we’re equipped to provide clarity on each step, ensuring you’re well-informed throughout.

If you need assistance in presenting your case to the IRS, Community Tax stands as a reliable ally. Leveraging years of experience and understanding the nuances of tax regulations, our team ensures that you’re well-prepared and well-represented in your quest for penalty relief.

The realm of IRS Penalty Abatement may seem overwhelming, but understanding its nuances and having the right guidance can make a world of difference. It’s essential to recognize the value of early action, accurate documentation, and strategic decision-making when approaching abatement scenarios. Community Tax offers that guiding hand, ensuring taxpayers can navigate these challenges with confidence. Remember, while penalties may be daunting, solutions are always within reach, especially with the right expertise and support by your side.

¿Aún tiene preguntas? Consulte nuestra sección de preguntas frecuentes.